General

Packaging is a discipline that evolves constantly and few aspects of packaging are changing as quickly as bioplastics. The speed of change in the bioplastics space is cause for some of the confusion that often surrounds the topic. But a lot of misunderstanding is simply due to the fact that it’s an incredibly heterogeneous space.

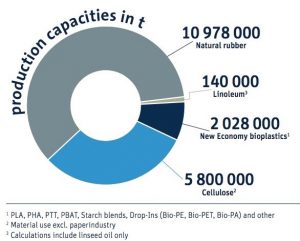

Image Credit: Institute for Bioplastics and Biocomposites

At first glance, the bioplastics category can seem incongruous, containing materials that are either biobased or biodegradable, or both. This translates to novel chemicals like PHA, “drop-ins” like bio-PET that are recyclable, and “old economy” bioplastics like rubber, gelatin, cellulose, and linoleum that were introduced before the availability of petrochemicals. Today, these old economy materials make up 17 million tons of the total 18.9 million tons of global bioplastics production capacity.

From 2013 to 2016

Though a minority of the current market, the production capacity of new economy bioplastics has increased consistently, clocking in at approximately 15% annually from 2013 to 2016. The subset of new economy materials consists primarily of either drop-in bioplastics that have chemically identical structures to conventional plastics like PET or PE; as well as new formulations like PLA or PHA that have chemical structures unrelated to conventional plastics.

Appropriately, many drop-in bioplastics that mirror conventional plastics can be recycled just like their petrochemical counterparts. A PET bottle made of petroleum is recyclable; and so is a PET bottle derived from sugarcane, corn, or potato starch. A PET bottle that contains a mix of petroleum and plant-based feedstocks, like the Dasani and Coca-Cola PlantBottle that includes 30% bioplastic content is also just as recyclable (with cap on, please). Just like conventional plastic packaging too; bioplastic packaging can have a recyclable base material, like bio-PE; but be made unrecyclable through problematic adhesives, coatings, barrier layers; and colorants, among other factors.

Bioplastics in 2020

Some bioplastics that are biodegradable are also biobased and derived from plants. PLA, for example; is fit for composting at industrial composting facilities and is created either by fermenting sugarcane or sugar beets or through the hydrolysis of wheat, potato, corn, or other starches. Other biodegradable plastics are not bio-based, like BASF’s ecoflex®; a PBAT polymer that is industrially compostable and made from adipic acid and butanediol.

Often, choosing a plant feedstock for a bio-based plastic, whether biodegradable or not, is predicated on geography. In some regions, feedstocks like corn are abundant and cheap. In others, sugar beets are plentiful. Corn starch is the primary feedstock for PLA in North America; cassava is used most in Asia, and sugarcane throughout South and Central America. NatureWorks, for example, sources the corn used to create its Ingeo PLA polymer from the 300 miles surrounding its Blair; Nebraska facility.

Apart from availability, other considerations like water and land requirements to produce one ton of a given feedstock are important; as is the tons of feedstock required to produce one ton of bioplastic. To produce bio-PE, for instance; sugar beets require 5 times less water and a 6 times smaller land footprint than wheat per ton of feedstock. On the other hand, only 10.86 tons of wheat are needed to produce 1 ton of bio-PE while 27.25 tons of sugar beets are necessary to produce the same quantity.